Beyond ChatGPT

Beyond ChatGPT: Enhancing Financial Strategies with Diverse AI Models

In the complex landscape of finance, a single AI model cannot fully address the diverse challenges that institutions face today. While ChatGPT excels in text generation and general tasks, it falls short in specialized areas crucial to finance, such as risk management and advanced analytics. To navigate these complexities, financial institutions need a diverse array of AI models, each tailored to meet specific demands.

The Importance of Diverse AI Models in Finance

AI tools each have unique strengths. For instance, while ChatGPT can enhance customer interactions, it may lack the precision needed for tasks like market predictions or financial forecasting. This highlights the need for a multi-model approach, ensuring that financial strategies are well-supported across various functions. According to PwC, leveraging diverse AI models allows firms to address specific operational challenges effectively, enhancing agility and decision-making.

Introduction to Anthropic: The AI Model You Need to Know

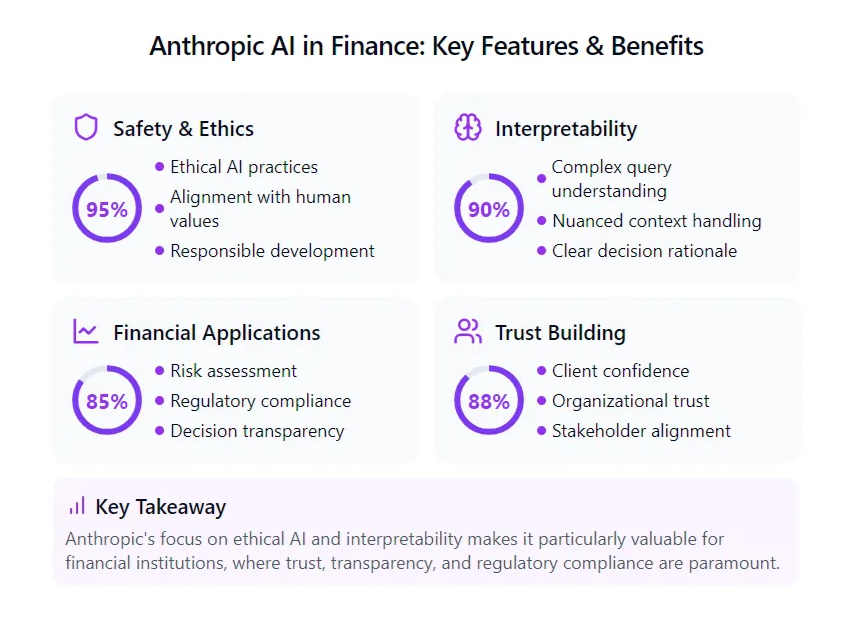

Among the many available AI models, Anthropic stands out for its focus on safety, interpretability, and ethical practices. Founded to create AI systems that align closely with human values, Anthropic provides distinct advantages over traditional models like ChatGPT. Its design emphasizes understanding complex queries and handling nuanced contexts, making it particularly valuable for financial institutions.

Anthropic’s commitment to ethical AI addresses critical concerns about transparency and fairness in financial decision-making. By incorporating Anthropic into your AI toolkit, you not only enhance performance but also adhere to high ethical standards, fostering trust within your organization and with clients. As noted by Rick Huckstep, the model’s approach to AI safety underscores its potential for responsible application in finance.

anthropic ai features and benefits visualization

Why Relying on a Single Model Like ChatGPT Could Limit Your Financial Strategy

While ChatGPT is a powerful tool, relying solely on it can hinder your financial strategy in several significant ways:

- Niche Expertise: ChatGPT may not be optimized for all financial tasks. For specialized functions like in-depth risk assessments or predictive analytics, dedicated models like Anthropic can deliver more targeted insights and analyses.

- Contextual Understanding: Each AI model is trained on different datasets, resulting in varied strengths. Utilizing only one model may lead to missed opportunities for insights that could be gleaned from others. While ChatGPT excels at generating text, it may not provide the same depth in analyzing financial trends or ensuring regulatory compliance.

- Adaptability: The finance industry is dynamic, and a single AI model may struggle to keep pace with new developments. A multi-model strategy allows for greater flexibility, enabling institutions to respond swiftly to evolving market conditions.

- Ethical Considerations: Models like Anthropic prioritize ethical AI practices, which are crucial in finance. Relying solely on models that do not prioritize these aspects can pose significant risks, especially in a field where transparency and fairness are paramount.

The Benefits of Using Multiple AI Models for Robust and Adaptive Solutions

Incorporating various AI models into financial operations offers several advantages:

- Better Accuracy: Each model has specific strengths. A diverse mix ensures a comprehensive analysis, with each model tackling its specialty, leading to more precise and reliable decision-making.

- Wider Coverage: No single model can address all financial needs. A variety of models ensures comprehensive support across all aspects of financial strategy, from data management to compliance.

- More Flexibility: The financial landscape is continually evolving. Using multiple models allows for swift adaptation to new information and changes, keeping your strategy current and effective.

- Reduced Risk: Relying solely on one model introduces risk if that model has limitations. A multi-model approach provides alternative options, enhancing the security and reliability of your strategies.

Staying Ahead: Keeping Up with AI Developments to Maximize Financial Insights

To fully leverage AI's potential, financial institutions must stay informed about the latest developments:

- Regular Updates: Continuously integrating new AI models and updates is essential for maintaining cutting-edge financial strategies. This requires staying informed about emerging technologies to ensure a competitive edge in the market.

- Ongoing Research: Keeping abreast of the latest AI research and trends enables the incorporation of innovative solutions, allowing institutions to capitalize on new opportunities as they arise.

- Collaborative Approach: Working closely with AI experts and technology providers can yield valuable insights into best practices for model integration, refining your overall AI strategy.

- Continuous Evaluation: Regularly assessing the performance of AI models ensures they meet evolving needs and deliver expected outcomes. This evaluation process allows for informed decision-making and necessary adjustments to maintain effectiveness.

Conclusion

While ChatGPT serves as a valuable tool in the financial sector, relying exclusively on it can limit strategic potential. By embracing a diverse range of AI models, including Anthropic, financial institutions can enhance accuracy, adaptability, and ethical practices in their operations. A multi-model approach provides the robustness needed to navigate the complexities of the financial industry effectively.