Customized RAG Systems for Financial Success

The Strategic Edge of Customized RAG Systems in Finance

Navigating finance today can feel like steering through a storm—constantly shifting data, regulations, and market volatility require firms to stay agile to succeed. Many institutions now rely on Retrieval Augmented Generation (RAG) to access timely insights, combining data retrieval with the transformative power of AI. Yet, a generic RAG approach is akin to navigating these waters with a small dinghy—insufficient for the complexity of financial decision-making. Customized RAG systems, built specifically for finance, provide the strategic edge needed to thrive in this high-stakes environment.

What is RAG, and Why is It Critical for Finance?

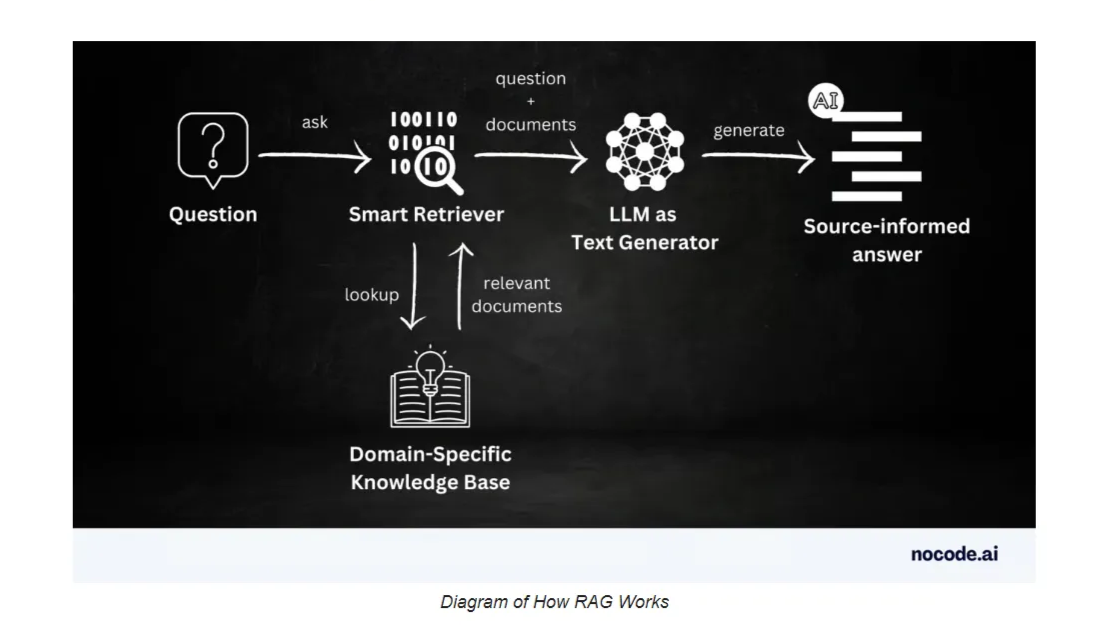

Retrieval Augmented Generation (RAG) enhances traditional AI models by integrating real-time data retrieval with generative capabilities, enabling firms to access both historical context and the latest information. In finance, where precision and timing are crucial, RAG’s ability to pull up-to-date market movements, regulatory shifts, and global economic data can make or break decisions. Unlike static models, customized RAG systems help financial professionals respond proactively, rather than reactively, making every insight more relevant and timely.

The Risks of Generic RAG Solutions in Finance

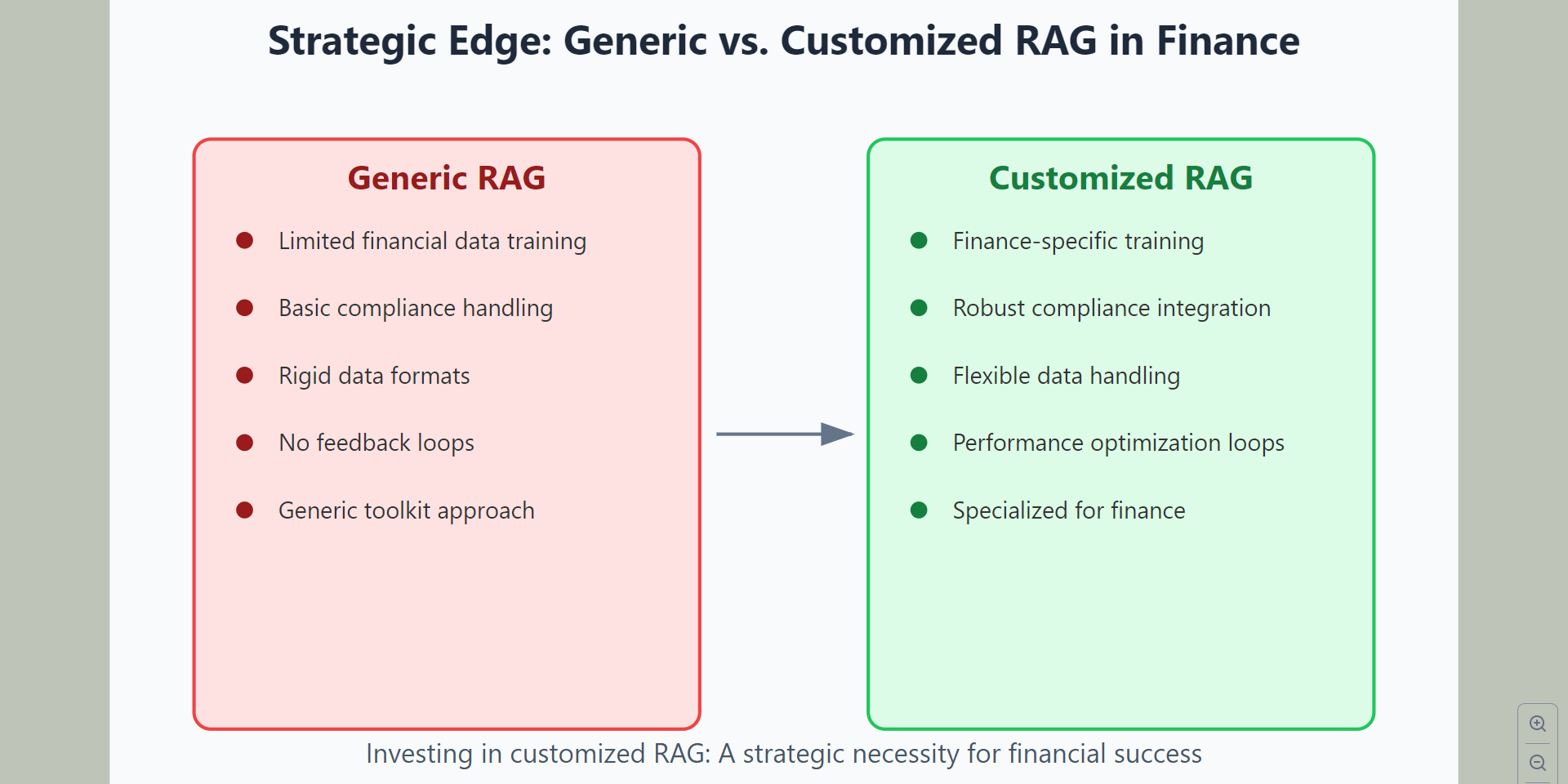

Off-the-shelf RAG frameworks, though functional in some domains, often lack the sophistication required for finance. Common limitations include difficulty handling proprietary data, complex financial formats, and rigid regulatory standards. Implementing a basic RAG setup is like using a general toolkit for a specialized task—it falls short.

According to a comprehensive guide on RAG, generic RAG systems often miss critical industry-specific requirements, resulting in data inaccuracies or compliance risks. For high-stakes finance, accuracy and regulation alignment are paramount, and only tailored systems can meet these demands.

a diagram showing how RAG systems work

Why Financial RAG Systems Need Customization

The specific nature of finance—where precise data handling and regulation adherence are mandatory—means customization is key. Adapting RAG systems to finance allows for more accurate data interpretation, from regulatory compliance to risk assessment, improving actionable insights. A Medium post on domain-specific RAG customization notes that customized RAG models are better at processing industry-specific data, delivering accuracy that out-of-the-box solutions can’t match.

Avoiding Common Pitfalls in RAG Implementation

When adopting RAG, financial firms often face pitfalls that impact effectiveness:

Inadequate Financial Data Training: Relying on generic datasets limits the model's relevance to financial nuances, leading to irrelevant insights.

Compliance Oversight: Finance demands stringent adherence to regulations; without a compliance-integrated RAG system, institutions risk fines or reputational damage.

Lack of Feedback Loops: Regular feedback helps refine models based on real-world performance. Without it, models lose relevance over time, leading to outdated insights.

Addressing these points through careful customization is essential for maximizing a RAG system’s effectiveness.

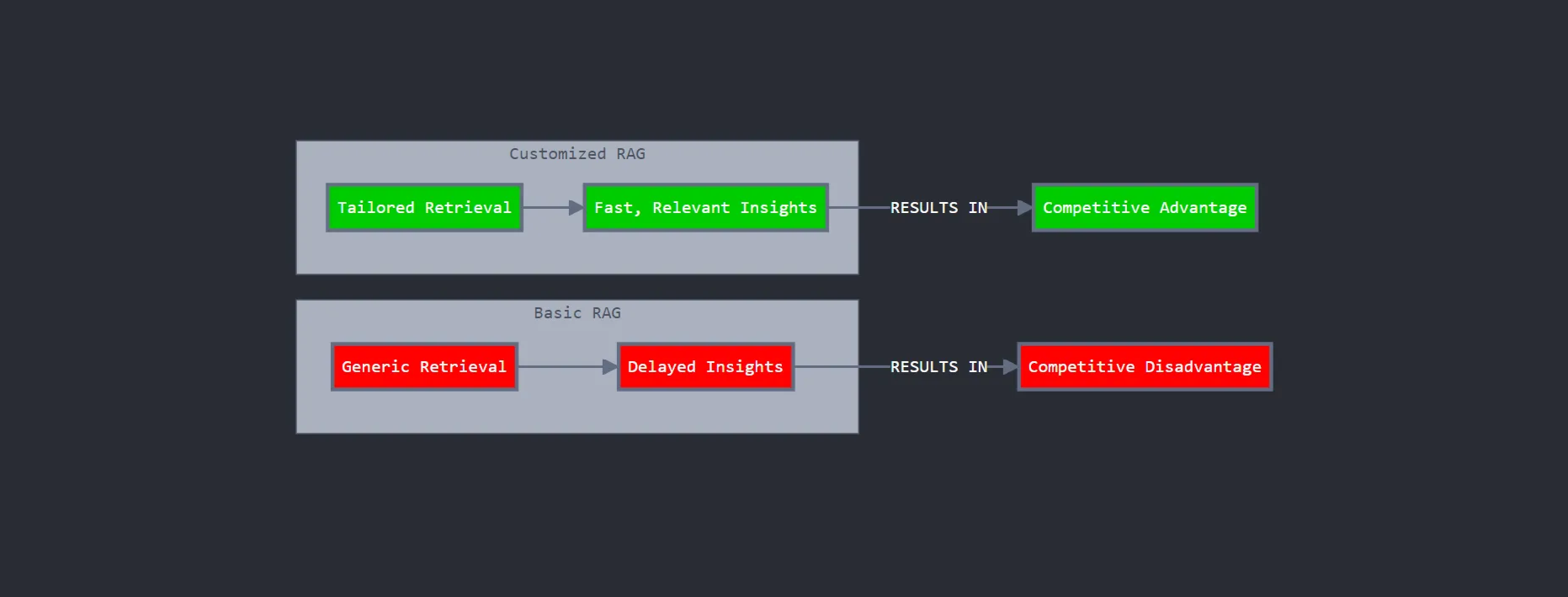

Customized RAG as a Competitive Investment

basic vs customized RAG systems comparison

Investing in customized RAG systems yields substantial returns for financial firms. Tailored RAG allows for precise, relevant information retrieval, reducing data latency and sharpening decision-making processes. A report on generic RAG limitations highlights that basic RAG setups often lack relevance, causing delays in accessing actionable insights—a costly issue in fast-paced markets. Customization resolves this by ensuring data relevance, providing firms a valuable competitive advantage.

Conclusion

As data becomes the foundation of financial success, outdated or incomplete systems are no longer viable. Customized RAG solutions enable financial institutions to navigate market dynamics and regulatory requirements with confidence. By investing in tailored systems, organizations not only enhance decision-making accuracy but also position themselves to anticipate and respond to market shifts with agility. In today’s competitive finance landscape, customized RAG systems are a strategic necessity, ensuring sustainable growth and success.