How AI is Revolutionizing Private Equity

The Accelerated Pace of Deal Making

The one thing AI is good at is reading large chunks of text super fast. Yes, it still makes mistakes but most users of AI are familiar with ChatGPT with no additional engineering around it. As a result, they think that AI fails or is not as good at reading documents with specificity, because that’s what you need when you are doing due diligence on a $B deal.

However, we see that our clients do use our AI Analysts for due diligence because we can hit much higher accuracy rates compared to the barebones ChatGPT enterprise which doesn’t have workflows catered to investment use case. Accordingly, we are seeing that private equity is undergoing a transformation, driven by artificial intelligence (AI) technologies that are fundamentally reshaping how deals are evaluated, executed, and closed. The traditional process, characterized by manual data analysis and lengthy due diligence, is being replaced by AI-driven solutions that promise faster decision-making, streamlined workflows, and increased competition.

Introduction: The Traditional vs. AI-Driven Deal-Making Process

an infographic comparing traditional vs ai-driven deal-making process

A typical investment process starts with receiving a teaser, doing a quick desktop search, and then receiving an CIM and doing further search on the Company and eventually entering into the data room, and again reading more docs and commercial due diligence reports / tax reports and any other docs prepared for various advisors.

This part of the job is fixed and happens in every deal around the world, every day and while they require attention to detail, these processes are slow, often leading to lengthy deal cycles. In our experience, we haven’t seen an investment banker who wanted to close a deal late, or a seller who wanted to lenghten the sales process, or a buyer who wanted to spend more time and money on due diligence. However, this process always takes months and until now there wasn’t a technology that could help us streamline this process, until large language models.

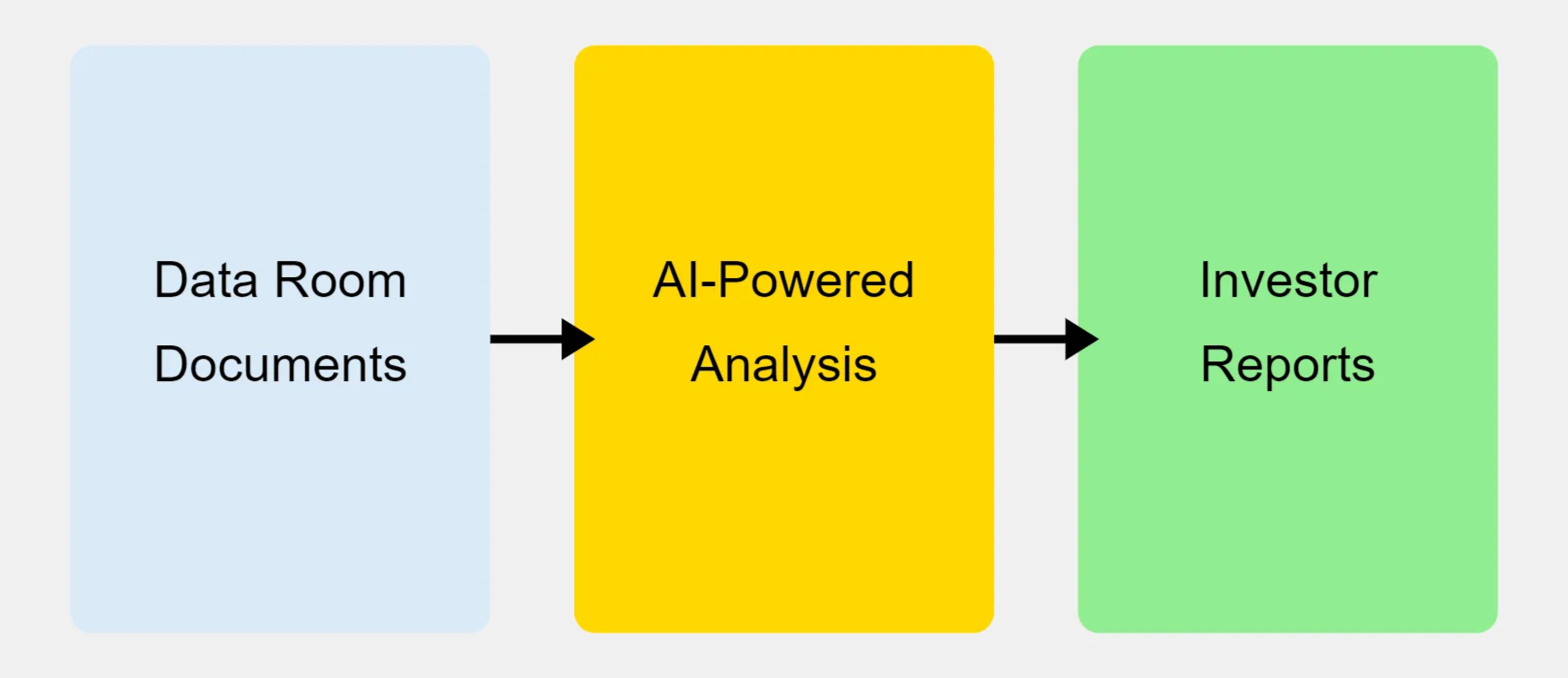

Faster Data Analysis: How AI Expedites Deal Review

One of the key advantages AI brings to private equity is its ability to process large volumes of financial data quickly. AI algorithms can sift through vast datasets, extracting key financial metrics, identifying trends, and flagging potential risks or opportunities far faster than human analysts. This accelerated data processing enables firms to make informed decisions more swiftly, ensuring they don't miss out on time-sensitive opportunities.

This is especially for reviewing deals at the early stages. As an investor, you do not want to spend time on deals that are not attractive enough, but you still need to do an initial desktop research and go through the CIM, hoping that this is the big deal of the year. AI is perfect for automating this part of the job. As an example, one of our client has AI Agents that read CIM’s and in 5 minutes, it creates an analysis of the deal based on Client’s previous deal memos.

The key thing here is, this is not a single shot ChatGPT prompt. Instead, we have AI Analysts doing work in the background, reading, extracting info, reading again, going to web, going to the Company’s website, to competitor’s websiges, comps in the public markets, and you can see it doing the work. We are told that work that would take 3-4 days happens just in minutes.

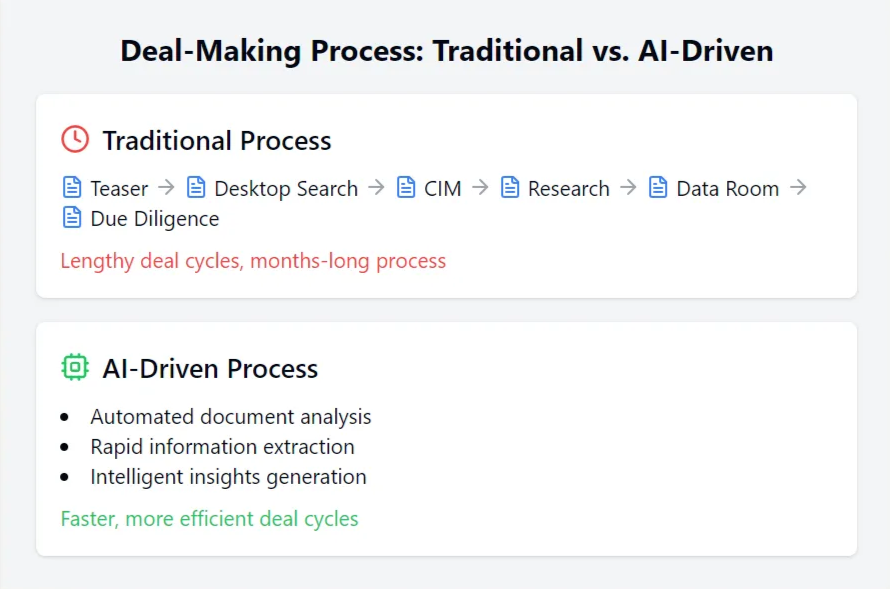

Automated Data Room Review: Streamlining Due Diligence Processes

In private equity deals, data room reviews can often be a time-consuming process. Sifting through hundreds of pages of documents can be a significant burden for investors. AI-powered tools can expedite this process by allowing investors to automatically review extensive documents.

an infographic illustrating streamlined due diligence processes

For instance, AI can analyze the documents in the data room, quickly identifying key information and generating reports for investors. This saves time compared to traditional review methods and speeds up the decision-making process, ensuring that no potential opportunities are missed.

Enhanced Decision-Making: Utilizing Data-Driven Insights in Private Equity

AI offers more than just speed; it provides intelligent insights that are critical for private equity firms. By analyzing current market conditions, competitor activities, and historical financial performance, AI can help investors make informed decisions and assess potential risks.

Example: Rather than relying solely on predictive analytics, AI can deliver data-driven insights by evaluating multiple scenarios and historical data to highlight potential growth areas. This allows private equity firms to make strategic decisions based on comprehensive analysis rather than just forecasts, ultimately enhancing their investment strategies.

Shortened Deal Cycles: The Impact of AI on Transaction Volume

AI’s ability to accelerate every step of the deal-making process, from financial evaluation to legal review, directly impacts the length of deal cycles. Transactions that traditionally took months to complete can now be finalized in a matter of weeks. As a result, private equity firms can handle a greater volume of deals within the same time frame, increasing their competitiveness in the market.

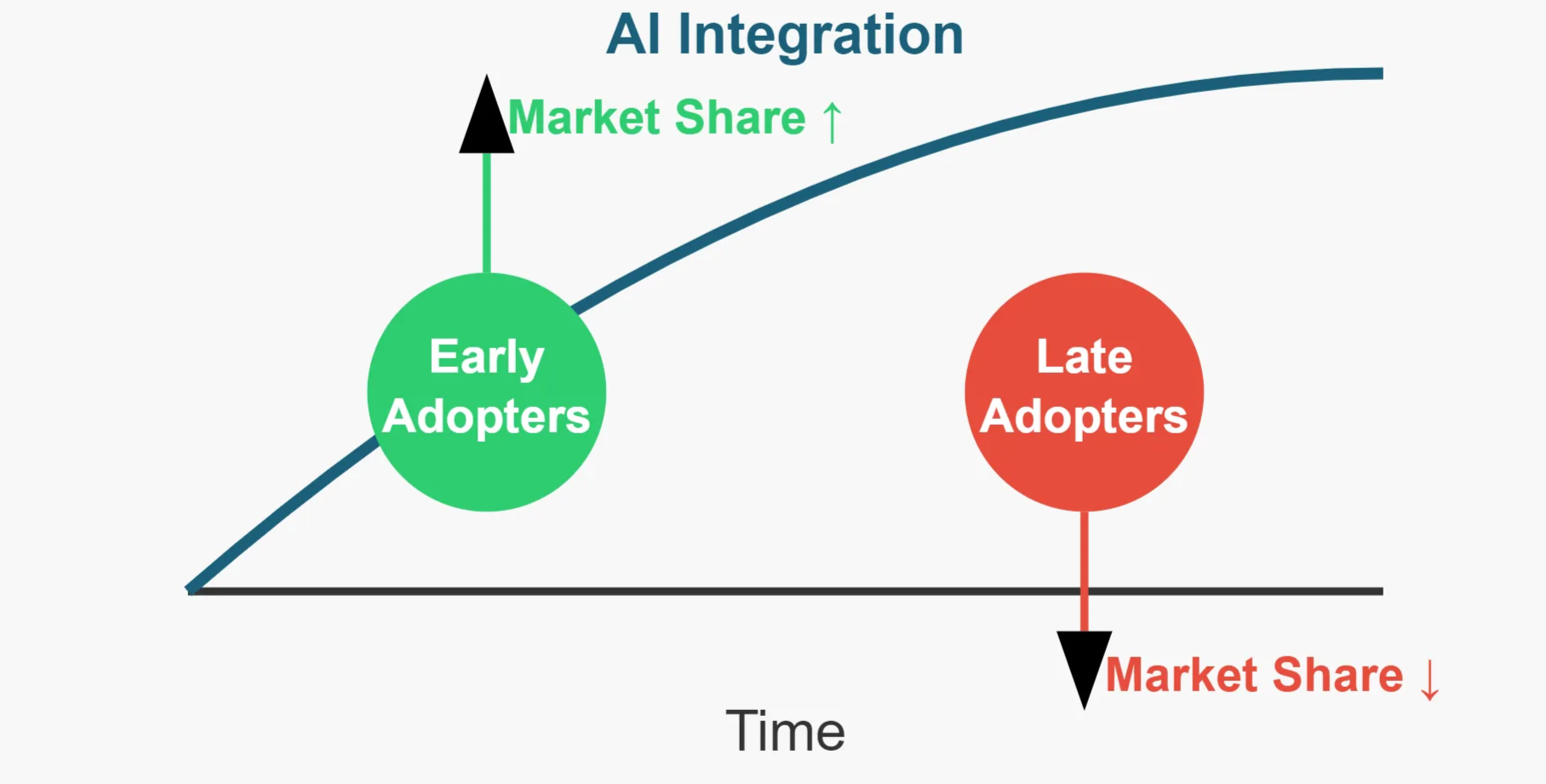

Increased Competition: AI as a Leveler in the Private Equity Field

With AI tools becoming more accessible, firms of all sizes can now leverage advanced data analysis and automation technologies. This levels the playing field, allowing smaller firms to compete with industry giants. AI helps smaller firms scale operations, manage larger deal volumes, and make data-driven decisions with greater accuracy, intensifying competition across the private equity landscape. However, this is only true if smaller firms adapt technology. While mega funds are adapting, they will need to adapt as well, and AI Analysts will be similar to hiring human analyts.

Future Outlook: The Long-Term Transformation of Private Equity by AI

AI is set to fundamentally reshape the landscape of private equity. In the coming years, we can expect AI to drive greater efficiency and automation in deal-making processes. Private equity firms that adopt AI early will be strategically positioned to capture market share, while those that delay integration may find themselves struggling to keep pace with rapid technological advancements. Embracing AI is not merely an option—it has become a competitive necessity for firms aiming to thrive in the evolving market.

diagram illustrating the future of AI in private equity

Ethical and Regulatory Considerations in AI-Driven Deal-Making

While AI brings speed and efficiency, it also raises ethical and regulatory questions. AI systems must adhere to stringent data privacy laws and ensure transparency in their decision-making processes. Private equity firms will need to navigate these challenges to leverage AI without compromising on compliance and ethics.