Lessons in Strategy from AlphaGo

Lessons in Strategy from AlphaGo

What can an ancient board game like Go teach us about modern investment strategies? A lot, if you ask AlphaGo, the AI that famously beat human champions at their own game. The lessons from AlphaGo's strategic thinking and decision-making go far beyond gaming—they offer valuable insights into how AI can be applied to financial markets.

The Evolution of AI in Strategic Games: A Brief Overview

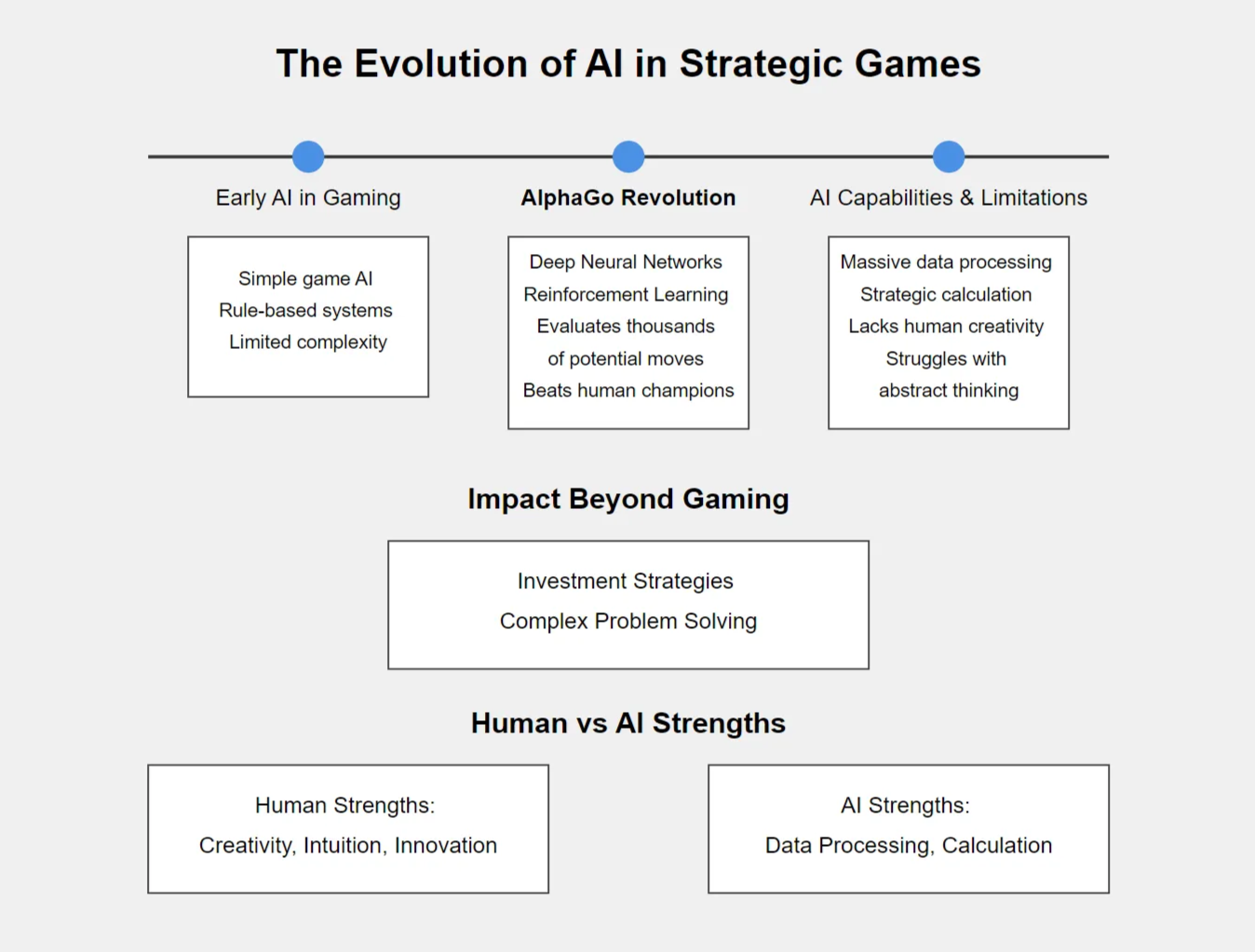

AI has long been a part of the gaming world, but AlphaGo revolutionized the field by taking on Go, a game known for its complexity and deep strategic elements. AlphaGo’s success came from its use of deep neural networks and reinforcement learning, which allowed it to evaluate thousands of potential moves and outcomes. This breakthrough has had a profound influence on AI development, pushing boundaries far beyond games into realms like investment strategy.

One of the most fascinating aspects of AI, as seen in AlphaGo’s gameplay, is its ability to process massive amounts of data to evaluate options. However, even AI has its limitations. While it can calculate numerous possibilities, it often struggles with the unpredictability and creativity humans bring to decision-making. In areas like deal structuring or pitching creative solutions, human intuition and innovation still surpass machine learning, highlighting AI's boundaries when it comes to creativity and abstract thinking.

an infographic describing the evolution of ai in strategic games

AlphaGo vs. Human Players: What Investors Can Learn

When AlphaGo defeated top human players, it did so not by mimicking human strategies but by developing its own, often counterintuitive moves. This is where AI truly excels—by thinking outside traditional frameworks.

For investors, this lesson is critical. While human investors often rely on intuition, sentiment, or historical patterns, AI offers a data-driven and unbiased perspective. AI systems can make decisions based on a broader set of variables, including market sentiment, geopolitical events, and financial trends, which humans might overlook.

What can investors learn? Relying solely on human expertise is limiting. Embracing AI in investment strategies can reveal new opportunities and patterns that would otherwise remain hidden.

Applying AI Strategies to Investment Decision-Making

The parallels between AlphaGo’s game strategy and investment decision-making are striking. Like AlphaGo, AI in finance relies on predictive models and real-time analysis. Just as the AI anticipates future moves in Go, AI-driven investment platforms use algorithms to forecast potential market changes, balancing risk and reward with precision.

Additionally, the use of reinforcement learning is key in investment strategies. AI systems learn from past decisions, adjusting future predictions based on new data, much like AlphaGo refined its strategy after each game. This continuous improvement allows AI to optimize investment portfolios more efficiently than human traders.

Case Studies: Successful Applications of AI in Investment

Several firms are already reaping the rewards of integrating AI into their investment strategies:

- Bridgewater Associates: This global investment firm leverages AI to interpret macroeconomic trends, optimize investment portfolios, and manage risk. By using machine learning models, Bridgewater can make data-driven decisions that outperform traditional methods.

- Two Sigma: Another hedge fund heavily reliant on AI, Two Sigma uses data science, machine learning, and advanced analytics to drive its investment decisions. Their AI systems process vast amounts of data to identify opportunities that are invisible to the human eye.

These firms demonstrate the power of AI in transforming the investment landscape, allowing investors to make smarter, more informed decisions.

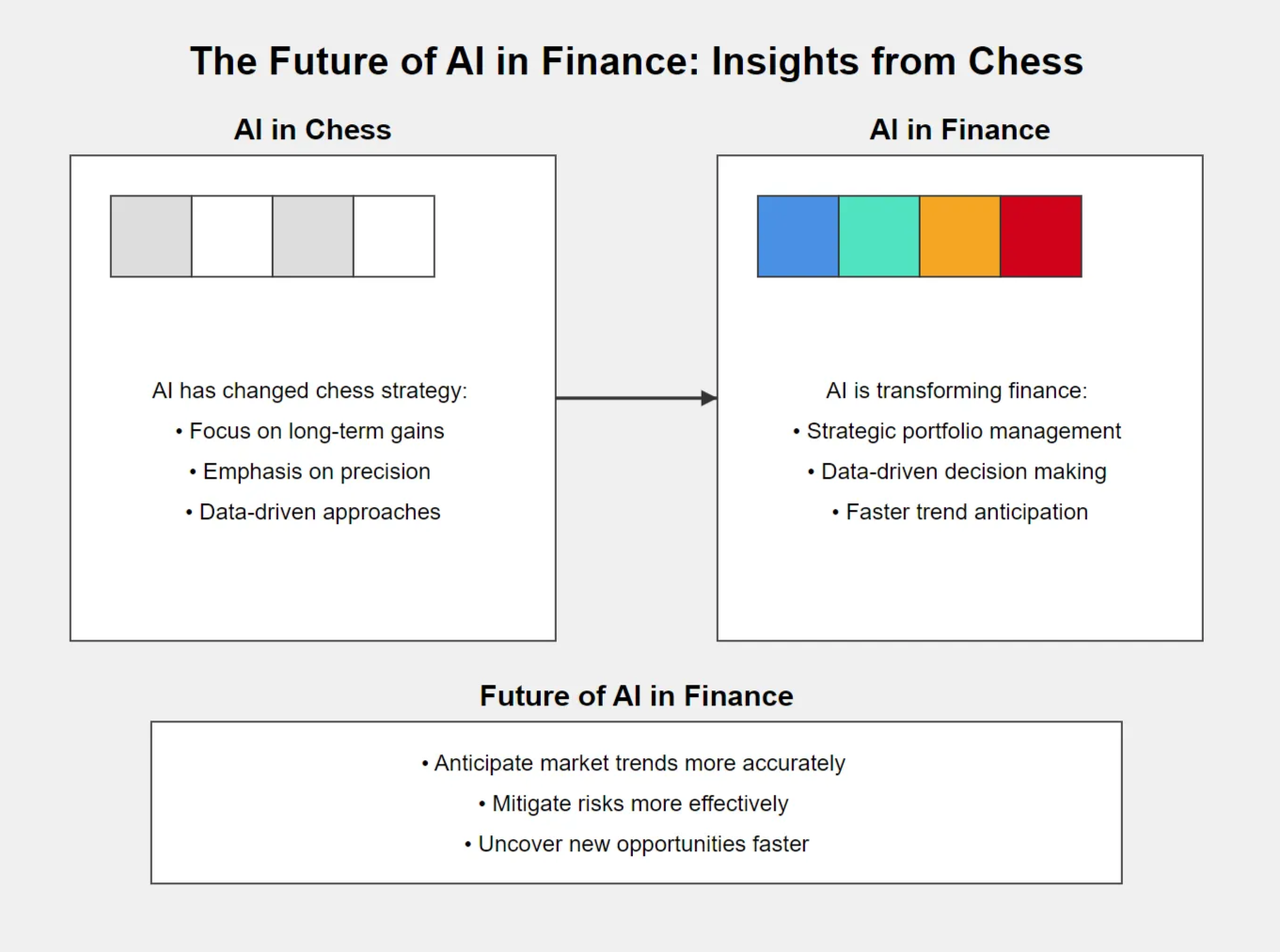

The Future of AI in Finance: Insights from Chess

an infographic illustrating the future of ai in finance

Looking at how AI has transformed games like Go and chess, it’s clear that the financial industry will continue to evolve as AI plays a more prominent role. In chess, AI has changed how human players approach strategy, focusing more on long-term gains and precision. Similarly, in finance, AI is pushing investors to adopt more strategic and data-driven approaches to portfolio management.

As AI continues to learn and adapt, it will help investors anticipate market trends, mitigate risks, and uncover new opportunities faster than ever before.

Unlocking the AI Advantage in Investment

The lessons learned from AlphaGo extend far beyond the game board. In the world of investment, AI is becoming an indispensable tool for staying competitive. Investors who integrate AI into their strategies today are setting themselves up for success in the future.

Are you ready to leverage AI in your investment strategy? Don’t wait—now is the time to act and stay ahead in an ever-evolving financial landscape.