Personalized AI in Finance

Why Every Firm Needs Its Own AI Analyst

Just as firms rely on different bankers for specific deals, they should have AI tailored to their unique strategies. A generic AI like ChatGPT isn't sufficient for specialized financial operations. Recent studies highlight that personalized AI models significantly outperform generic models in niche financial applications —an AI that works, thinks, and acts like you.

Some of the recent studies on the topic are as follows:

- How to Build and Deploy Custom AI Models

- How Localized AI Models Impact Financial Services

- The Future of Banking: AI Personalization as a Catalyst for Customer Loyalty

- Leveraging AI Models for Personalized Investment Recommendations in Fintech Apps

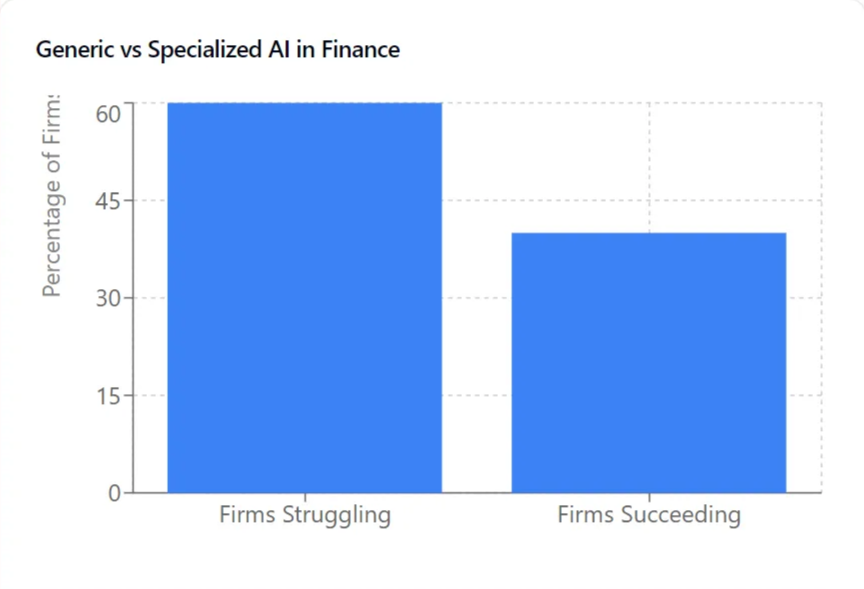

Moving Beyond Generic AI

Generic AI models like OpenAI’s GPT are too broad for specialized financial needs. According to McKinsey, 60% of firms struggle to leverage generalized AI for strategic tasks. These ten miss nuanced details in investment strategies, leading to suboptimal insights. By training your own AI analyst, you create a system that understands your specific style, enhancing predictions, risk management, and decision-making.

***a graph comparing generic vs specialized ai in finance according to data gathered from McKinsey.

Customizing Your Strategy

Each investment fund has a unique focus—whether it’s growth, value, or risk-oriented strategies. AI tailored to your fund’s approach ensures better performance and adaptability to market changes. For instance, ESG-driven funds benefit from AI models designed to track sustainability trends, regulatory shifts, and emerging opportunities , while high-frequency trares an AI optimized for speed and precision .

Key Insight:

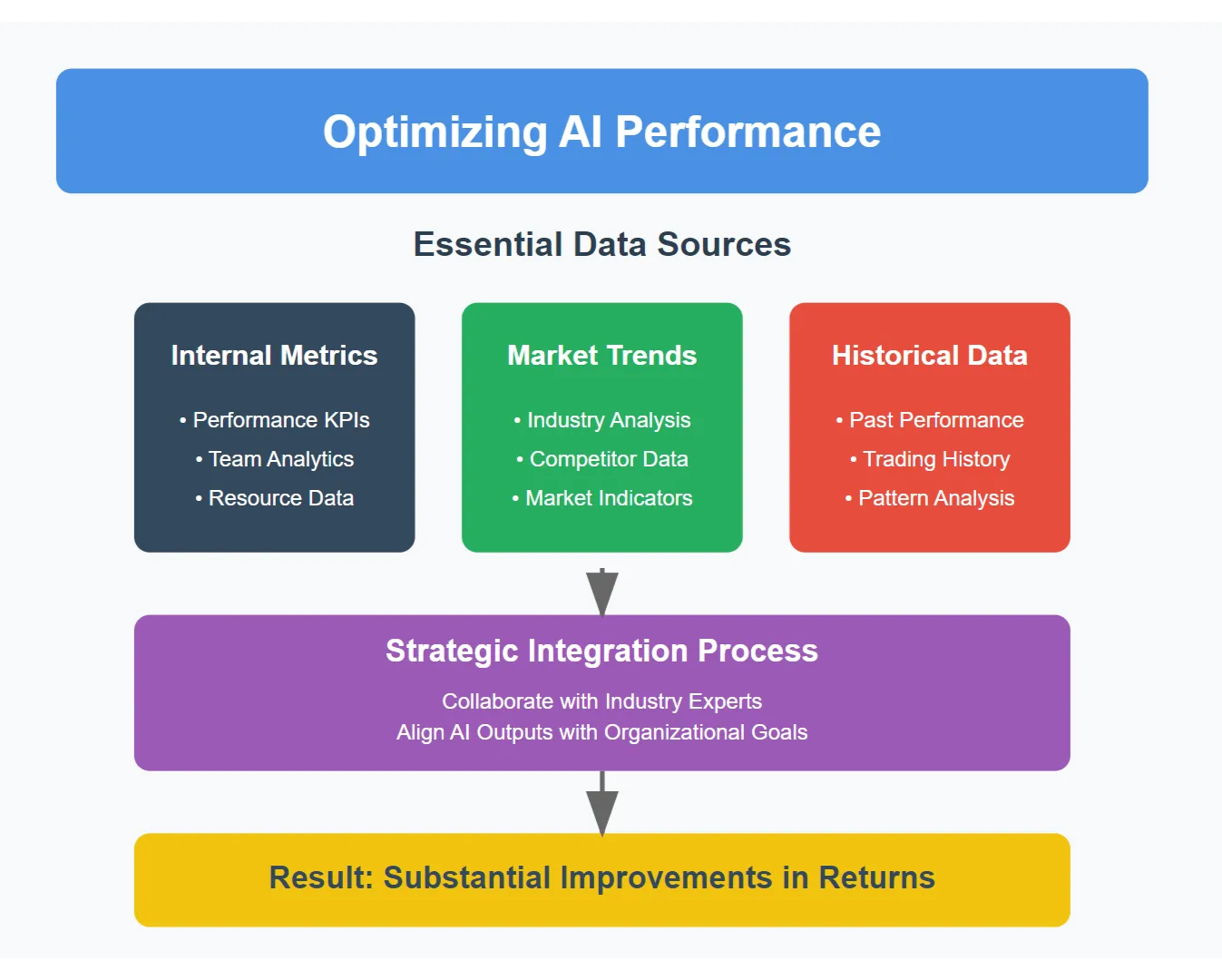

an infographic illustrating ai performance optimization

To ensure AI performs optimally, it's crucial to train it using the right data—this includes your organization's internal performance metrics, relevant market trends, and historical trading information. Integrating AI into data-driven strategies can lead to substantial improvements in returns. Collaborating with industry experts to align AI outputs with your goals and regularly updating the system ensures that your strategies stay relevant as market dynamics change.

The Future: Custom AI for Every Fund

As AI conhape finance, personalized models will become the norm. According to Gartner, 80% of financial institutions will deploy custom AI solutions by 2027. These tailored systems will help firms operate more efficientlter investment decisions, and give them a competitive edge in an increasingly complex market.