Private markets x AI

The Next Frontier: How AI Will Transform Private Markets and Fuel Their Growth

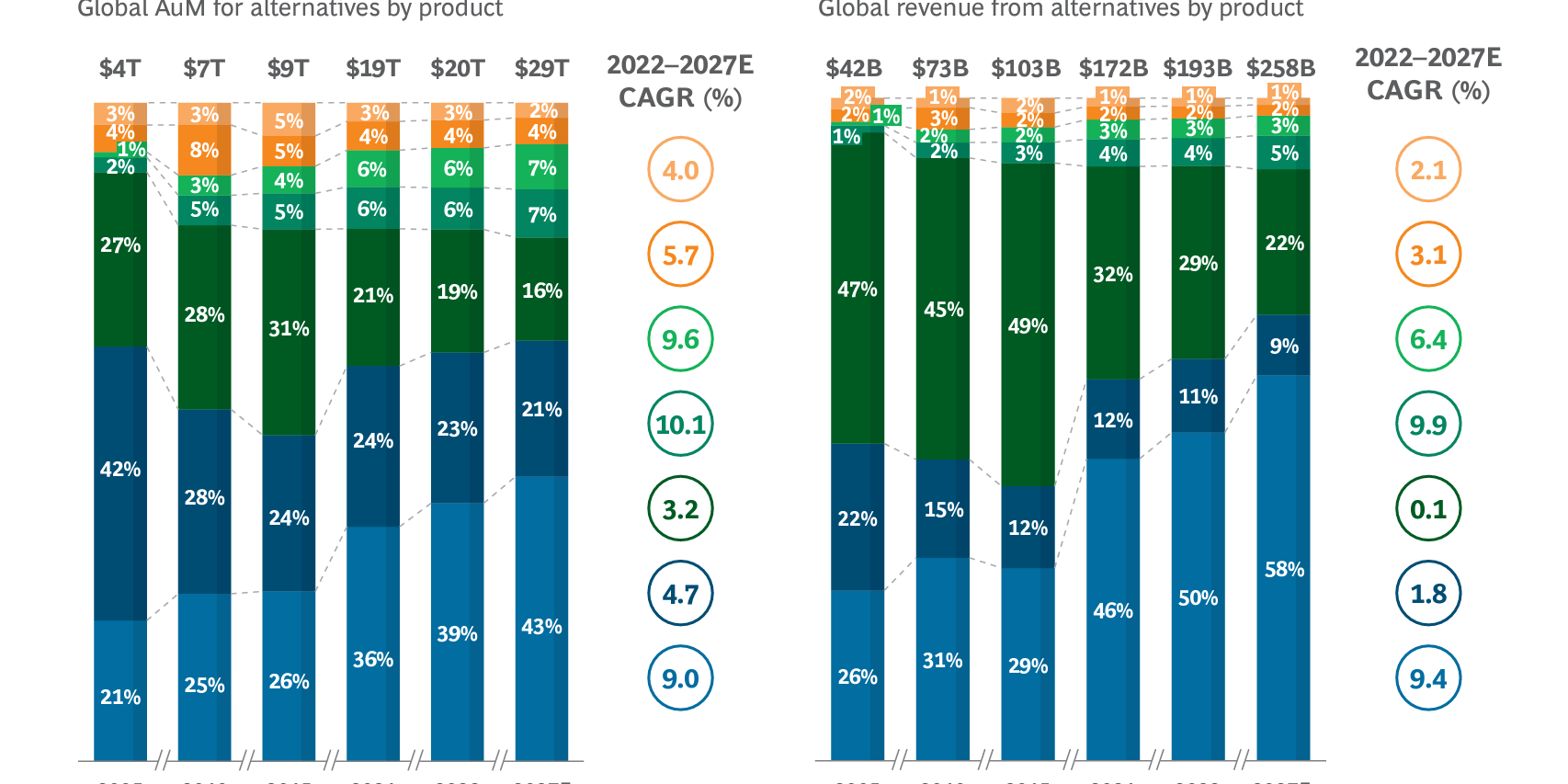

Private equity (PE) and private debt are on track to dominate the alternative investment landscape, expected to generate 70% of revenues by 2028, according to a forecast by Boston Consulting Group (BCG). This projection is up from a 60% estimate just last year, highlighting the accelerating momentum in private markets. Recent high-profile deals by firms like Apollo Global Management and BlackRock, along with burgeoning partnerships between banks and PEs, underscore this trend.

But beyond the numbers lies a deeper story: we are at a critical turning point for private markets. The forces shaping the industry today have the potential to redefine it entirely in the years to come.

A Secular Shift in Private Markets

On one hand, there’s a clear and enduring secular trend:

- Private equity is replacing traditional banks. As regulatory pressures increase, banks are pulling back from certain types of lending, leaving a void that private debt funds are eager to fill.

- More companies are choosing to stay private. The complexities and costs of public markets—coupled with the abundance of private capital—make going public less appealing for many businesses.

This alone would be enough to sustain the rapid growth of private markets. But there’s another, less predictable force at play: Artificial Intelligence.

Why AI and Private Markets Are a Perfect Match

AI’s potential to reshape private markets stems from the very challenges that define them:

Unstructured Data Dominates Private Markets:

Unlike public markets, where financial reports follow standardized formats, private markets are a mosaic of inconsistency. Each company has its own reporting structure, and Excel models differ wildly between firms. For businesses operating across multiple countries, the variability only increases, with language barriers and document diversity compounding the challenge.AI thrives in these environments. By processing and analyzing unstructured data, AI can bring order to chaos—extracting insights from disparate sources and uncovering patterns that humans might miss.

Transparency and Liquidity in Private Markets:

Today, private markets are often criticized for their opacity. Valuations can be inconsistent, due diligence is labor-intensive, and transactions lack the liquidity of public markets.AI has the potential to change all of this. With the ability to analyze vast amounts of data quickly and accurately, AI can streamline due diligence, improve valuation accuracy, and even pave the way for new secondary market platforms that enhance liquidity.

Global Scale and Adaptability:

Private markets are increasingly global, with investors seeking opportunities across continents. AI’s capacity to work across languages, jurisdictions, and reporting standards makes it an invaluable tool for navigating this complexity.

The Untapped Potential of AI in Private Markets

Despite these capabilities, most of the market has yet to incorporate AI into their vision for the future of private markets. However, history suggests that such technologies are rarely ignored for long, especially when the competitive advantages they provide become clear.

AI could be the catalyst that accelerates the growth of private markets far beyond current expectations. By reducing inefficiencies and making private markets more accessible, AI has the potential to attract even more capital into alternatives, amplifying the secular trends already in motion.

The Road Ahead

We are still in the early days of AI’s adoption in private markets, but the writing is on the wall. As tools become more sophisticated and accessible, their integration into private equity and private debt workflows will go from a competitive edge to a necessity.

For investors, the implications are profound. Those who embrace AI early will likely find themselves at the forefront of a transformed market, while those who wait risk falling behind.

The convergence of secular trends and AI-driven innovation could mark the beginning of a new era for private markets—one that is more transparent, liquid, and expansive than ever before. For anyone watching the alternatives space, this is a moment to pay attention.

As private equity and debt continue to capture an ever-growing share of the market, the question isn’t whether AI will play a role, but how soon and to what extent. One thing is clear: the combination of these forces will shape the future of private markets—and the opportunities within them—for years to come.