Top 10 Financial AI Tools for 2024

At a Glance: The Best Financial AI Tools

- AnalystAI: Best for comprehensive market analysis and real-time data analysis.

- Acorns: Best for beginner investors and micro-investing.

- Feedly: Best for staying updated with financial news and trends.

- AlphaSense: Best for in-depth market research and document analysis.

- DataRobot: Best for enterprise-level predictive analytics.

- Alpaca: Best for developers seeking to automate trading strategies.

- Harvey: Best for conversational AI and quick market insights.

- Trade Ideas: Best for active traders looking for real-time trading strategies.

- QuantConnect: Best for open-source algorithmic trading.

- Tickeron: Best for real-time trading signals.

- Kensho: Best for institutional investors focusing on macroeconomic data.

What is a Financial AI Tool?

A Financial AI Tool is a powerful software application that uses artificial intelligence (AI) to enhance financial analysis and decision-making. These tools employ advanced algorithms and machine learning to automate and optimize various financial processes. By combining data from diverse sources, they provide deep insights into market trends, asset performance, and economic conditions. Financial AI Tools streamline data collection and processing, offer precise forecasts, and identify potential investment opportunities, enabling financial professionals and organizations to make more informed and confident decisions.

Why Financial AI Tools Matter in 2024

As we move through 2024, Financial AI Tools are becoming more important than ever, thanks to the growing complexities and constant changes in the financial markets. Traditional analysis methods often can't keep up in today’s fast-paced environment, which is why these AI-driven tools are now essential for anyone looking to stay ahead of the curve. By providing real-time data and advanced predictive analytics, they empower users to make quicker and more informed decisions in response to market shifts.

What sets Financial AI Tools apart is their ability to rapidly process and analyze massive amounts of data, continuously adapting to new information. This means they not only provide a snapshot of the current market but also predict future trends with remarkable accuracy. For individual investors, this can mean smarter investment choices and better risk management. For large institutions, it’s about gaining a competitive advantage, optimizing portfolios, and strategically planning for the future.

In today’s dynamic financial landscape, where every second counts and new information is constantly emerging, Financial AI Tools are no longer a luxury—they’re a necessity. They help everyone from novice investors to seasoned financial professionals navigate the ever-evolving markets with confidence and clarity, making them indispensable for achieving both short-term gains and long-term strategic goals.

How We Evaluated the Best Financial AI Tools

When assessing the top financial AI tools, we took a detailed and comprehensive approach to ensure our evaluation was both robust and insightful. Here’s a breakdown of the key criteria we focused on:

Data Processing Capabilities: We looked at how well each tool handles large volumes of data, both structured (like financial reports) and unstructured (like news and social media). We paid attention to their ability to integrate different data sources and process data in real time, which is critical for making timely decisions.

Predictive Accuracy: The reliability of AI-generated forecasts and risk assessments was a major factor. We examined how accurately each tool predicts market trends and asset movements, considering their performance on historical data and consistency in predictions. Accuracy is crucial for minimizing errors and maximizing gains.

User Experience: A tool’s interface should be intuitive and user-friendly for all levels of users. We evaluated how easy it is to navigate, the clarity of visualizations, and the overall accessibility of features, all of which impact user satisfaction and efficiency.

Integration Capabilities: We reviewed how well each tool integrates with existing financial software, data feeds, APIs, and third-party platforms. Seamless integration ensures smooth data flow and interoperability with other systems, which is vital for streamlined operations.

Security and Compliance: Data security and adherence to regulatory standards are non-negotiable in the financial industry. We assessed each tool’s security measures, such as data encryption and compliance with regulations like GDPR and CCPA, to ensure the safety and legality of data handling.

Support and Training: The quality of customer support and the availability of training resources were also considered. Effective support and onboarding are key to helping users get the most out of the tool and ensuring a smooth adoption process.

Cost-Effectiveness and ROI: Lastly, we analyzed the value each tool offers relative to its cost. We considered pricing in relation to the benefits provided—like improved accuracy and decision-making—and the potential return on investment (ROI) it could deliver.

This approach allowed us to provide a balanced evaluation of each tool's strengths and weaknesses, helping you make an informed choice based on your specific needs.

The 10 Best Financial AI Tools for 2024

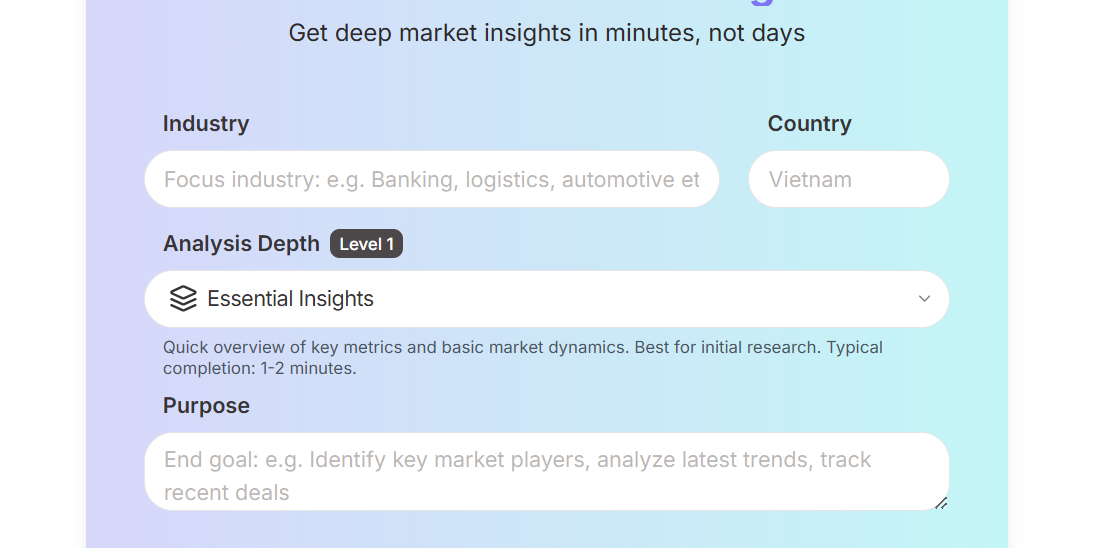

1. AnalystAI — Best for Comprehensive Financial Forecasting

AnalystAI stands out as a top choice for financial forecasting and market analysis. Designed to serve both institutional and retail investors, this advanced AI-powered platform combines several AI models to offer highly accurate predictions and in-depth insights. It processes vast amounts of data in real time, making it a valuable tool for financial planning, risk management, and strategic decisions.

- Key Features:

- Multi-Model AI Engine: Leverages various AI models to ensure robust predictive accuracy.

- Real-Time Data Processing: Provides up-to-the-minute analysis across different financial markets.

- Customizable Dashboards: Lets users tailor their dashboards with widgets, charts, and reports to fit their needs.

- Advanced Integration Capabilities: Connects seamlessly with Bloomberg Terminal, Reuters, and other major financial platforms.

- Scenario Analysis and Stress Testing: Offers tools for evaluating different market conditions and their potential impact on portfolios.

- Why We Like It: AnalystAI delivers detailed, data-driven insights that support both strategic planning and everyday decision-making.

- Pros: High accuracy in predictions, extensive integration options, user-friendly interface, and exceptional customer support.

- Cons: More expensive than some simpler tools; beginners might face a steep learning curve.

- Pricing: Starts at $20 per month.

- Website: https://www.analystai.ai/

2. Acorns — Best for Beginner Investors

Acorns is a user-friendly, AI-driven platform designed for those new to investing. It makes it easy to start with minimal financial commitment by automatically investing your spare change from everyday purchases into diversified portfolios. Ideal for beginners, Acorns simplifies the investing process and helps you build your portfolio over time.

- Key Features:

- Round-Ups: Automatically invests spare change from purchases made with linked debit or credit cards.

- Automated Portfolio Management: Uses AI algorithms to manage and rebalance your portfolio according to your preferences.

- Education Resources: Offers valuable content to help new investors understand the basics of investing.

- Retirement Accounts (Acorns Later): Provides automated IRA options tailored to your income and financial goals.

- Why We Like It: Acorns is a great choice for those who want to start investing effortlessly and build their portfolios gradually.

- Pros: Affordable, easy to set up, automated investing, and helpful educational tools.

- Cons: Limited investment options and may not cater to experienced investors seeking advanced features.

- Pricing: Starts at $3 per month.

- Website: https://www.acorns.com/

3. Feedly — Best for Staying Updated on Financial News

Feedly is an AI-powered news aggregator that helps finance professionals and investors stay on top of the latest financial news and trends. With its AI tool, Leo, Feedly sorts through vast amounts of information to deliver the most relevant content, saving time and improving decision-making.

- Key Features:

- AI-Driven News Aggregation (Leo): Leverages AI to highlight the most pertinent news, research, and updates.

- Customizable Feeds: Allows users to create personalized news streams based on topics, keywords, or industries.

- Team Collaboration: Share and discuss news feeds and insights with colleagues.

- Integration with Other Apps: Connects with tools like Slack, Evernote, Trello, and more.

- Why We Like It: Feedly efficiently filters a vast amount of financial news, helping users focus on the most important information.

- Pros: Highly customizable, user-friendly, integrates well with other platforms, and offers a cost-effective solution.

- Cons: Primarily focused on news aggregation and lacks advanced analytical tools.

- Pricing: Free version available; premium plans start at $8 per month.

- Website: https://feedly.com/

4. AlphaSense — Best for In-Depth Market Research

AlphaSense is a sophisticated market intelligence platform that leverages natural language processing (NLP) and machine learning to deliver deep insights from a wide range of financial documents, research reports, and news.

- Key Features:

- AI-Powered Search Engine: Utilizes NLP to locate relevant information in earnings calls, SEC filings, news articles, and broker research.

- Document Analysis and Summarization: Extracts and summarizes key insights from extensive documents.

- Sentiment Analysis: Assesses market sentiment through analysis of news, reports, and social media.

- Advanced Filters and Alerts: Enables users to set up alerts for specific companies, industries, or keywords.

- Why We Like It: AlphaSense excels in providing fast, reliable insights for firms that depend on thorough market research.

- Pros: Extensive data repository, effective filtering, supports strategic decision-making, and offers strong customer support.

- Cons: Higher cost may be prohibitive for smaller firms; requires some training to master.

- Pricing: Custom pricing available upon request.

- Website: https://www.alpha-sense.com/

5. DataRobot — Best for Predictive Analytics

DataRobot is a comprehensive enterprise AI platform designed to automate the development, deployment, and management of machine learning models. It's ideal for organizations aiming to leverage predictive analytics without needing extensive AI expertise.

- Key Features:

- Automated Machine Learning (AutoML): Simplifies the creation and deployment of machine learning models with minimal manual effort.

- AI Transparency and Explainability: Offers clear explanations of model predictions and decision processes.

- Integration with Data Platforms: Easily integrates with data platforms like Snowflake, AWS, and Azure.

- Time Series Modeling: Advanced forecasting tools tailored for financial market predictions.

- Why We Like It: DataRobot’s automation capabilities significantly cut down the time needed to deploy predictive models, making it accessible for organizations without a large team of data scientists.

- Pros: High accuracy, scalable solutions, automated end-to-end processes, robust community support.

- Cons: May require some technical expertise for optimal setup and management; pricing can be high.

- Pricing: Custom pricing available upon request.

- Website: https://www.datarobot.com/

6. Alpaca — Best for Automated Trading

Alpaca is a commission-free trading platform tailored for developers and tech-savvy investors who want to automate their trading strategies using APIs and machine learning. It's particularly suited for algorithmic trading and provides powerful tools for both individual traders and fintech developers.

- Key Features:

- API-First Platform: Offers a robust API for creating and deploying custom trading algorithms.

- Commission-Free Trading: Trades stocks and ETFs without any commissions.

- Paper Trading Environment: Enables users to test their strategies in a risk-free, simulated environment.

- Integration with Python Libraries: Seamlessly integrates with popular Python libraries such as pandas and NumPy.

- Why We Like It: Alpaca’s API access provides extensive flexibility for automating trading strategies, making it a great choice for individual traders and fintech developers alike.

- Pros: Commission-free trades, developer-friendly, comprehensive paper trading tools, and extensive integration options.

- Cons: Lacks advanced charting and research features; best suited for developers rather than casual traders.

- Pricing: Free for basic users; premium features available.

- Website: https://alpaca.markets/

7. Harvey — Best for Conversational AI

Harvey is a cutting-edge conversational AI platform designed for financial professionals. It uses natural language processing to deliver instant insights into market data, trends, and news through a chat-based interface. Harvey’s ability to interact conversationally makes it a standout tool for real-time financial decision-making.

- Key Features:

- Conversational AI Interface: Provides market insights via an easy-to-use, natural language interface.

- Data Integration: Aggregates data from diverse sources, including news feeds, financial statements, and analyst reports.

- Customizable Alerts and Notifications: Allows users to set personalized alerts for market events, price changes, and breaking news.

- Collaboration Tools: Facilitates team collaboration by sharing insights and data directly within the platform.

- Why We Like It: Harvey’s conversational approach makes complex financial data accessible and understandable, catering to users of all experience levels.

- Pros: User-friendly, highly interactive, customizable alerts, and strong collaborative features.

- Cons: Focuses on conversational AI and data integration; lacks advanced trading tools.

- Pricing: Contact for pricing details.

- Website: https://www.harvey.ai/

8. Trade Ideas — Best for Active Traders

Trade Ideas is a powerful AI-driven platform tailored for active day and swing traders seeking real-time trade signals and automated trading capabilities. It offers advanced tools for stock scanning, strategy testing, and community engagement.

- Key Features:

- AI-Powered Stock Scanner: Provides real-time scanning and alerts for potential trade opportunities.

- Backtesting and Simulated Trading: Allows users to test and refine trading strategies in a simulated environment.

- Integrated Brokerage Plus: Supports fully automated trading strategies for seamless execution.

- Community and Chat Rooms: Connect with other traders, share insights, and discuss strategies.

- Why We Like It: Trade Ideas excels with its robust AI-powered signals and vibrant community, making it a top choice for active traders who need real-time insights and automation.

- Pros: Real-time alerts, advanced automation, strong community support, and customizable features.

- Cons: Higher cost and a steep learning curve for those new to trading.

- Pricing: Plans start at $89/month.

- Website: https://www.trade-ideas.com/

9. QuantConnect — Best for Open-Source Algorithmic Trading

QuantConnect is an open-source platform designed for algorithmic trading, providing a robust environment for developing, testing, and deploying trading strategies. It caters to quantitative traders and developers seeking extensive control over their trading algorithms.

- Key Features:

- Open-Source Platform: Offers access to a diverse range of data and trading algorithms.

- Multi-Asset Strategy Development: Supports trading across various asset classes, including stocks, forex, cryptocurrencies, and futures.

- Cloud-Based Backtesting: Provides fast and scalable backtesting to refine and test strategies.

- Community-Contributed Algorithms: Features a library of algorithms contributed by the QuantConnect community.

- Why We Like It: QuantConnect stands out for its flexibility and extensive control, making it an excellent choice for algorithmic traders who want to build and deploy custom strategies.

- Pros: Open-source, highly flexible, strong community support, and broad asset class coverage.

- Cons: Requires programming knowledge and is not suited for beginners.

- Pricing: Plans start at $60/month.

- Website: https://www.quantconnect.com/

10. Tickeron — Best for Real-Time Trading Signals

Tickeron is an AI-powered platform designed to deliver real-time trading signals, portfolio management tools, and advanced pattern recognition for traders in stocks, forex, and cryptocurrencies. It's ideal for those seeking actionable insights based on up-to-the-minute data analysis.

- Key Features:

- AI-Driven Pattern Recognition: Detects bullish and bearish patterns in real time.

- Real-Time Trading Signals: Offers buy and sell signals generated through AI analysis.

- Risk Management Tools: Provides features to help manage and mitigate portfolio risk.

- Integration with Brokers: Compatible with major brokerage platforms.

- Why We Like It: Tickeron excels at providing timely and actionable trading signals, making it a valuable resource for traders actively engaged in the market.

- Pros: Real-time signals, effective risk management tools, user-friendly interface.

- Cons: Subscription fees can be relatively high; best suited for active traders.

- Pricing: Starts at $20/month.

- Website: https://tickeron.com/

Choosing the Right Financial AI Tool for You

When selecting the ideal financial AI tool, consider your specific needs, budget, and the level of sophistication you're looking for. Here’s a brief guide to help you choose:

- For Comprehensive Financial Analysis: AnalystAI is a top choice. Its advanced technology and user-friendly design make it perfect for detailed market analysis and strategic decision-making.

- For Beginner Investors: Acorns is an excellent starting point. It offers an easy way to begin investing with minimal effort and helps build portfolios gradually.

- For In-Depth Market Research: AlphaSense provides powerful tools for deep market research and document analysis, making it ideal for professionals needing detailed insights.

Each tool on this list is designed to meet different needs, ensuring there is a financial AI solution tailored to every type of user.