Why Investors Shouldn’t Build Their Own AI

🚀 The AI Gold Rush

AI is moving fast, and while it’s reasonable to be skeptical, there is a chance that it really changes how investing is done. It’s similar to having base, bear, and bull scenarios, and the bull scenario is the whole investing game changes. As investors, our job is to underwrite the risks and here, one has to underwrite the risk that AI changes how we work. If that’s the case, you should do something about it. The question is, what’s the best way to use AI, and we argue here that it’s not building it in house.

🔍 The Talent Deficit:

First question is, have you ever hired a software engineer? A data scientist? An AI Engineer? Likely the answer is no. The second is, best AI/ML engineers have great options, great packages and most would rather work in tech directly then work in an investment fund. If you are Blackrock, you can hire them, but what if you do not manage $1 trillion?

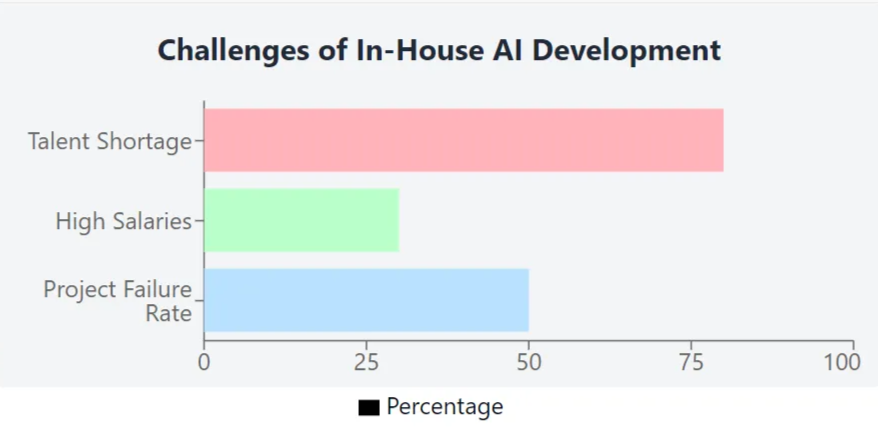

Key Insight:

- Talent Gap: over 80% of companies are struggling to find the AI talent they need.

💰 The Cost of Talent: Breaking the Bank

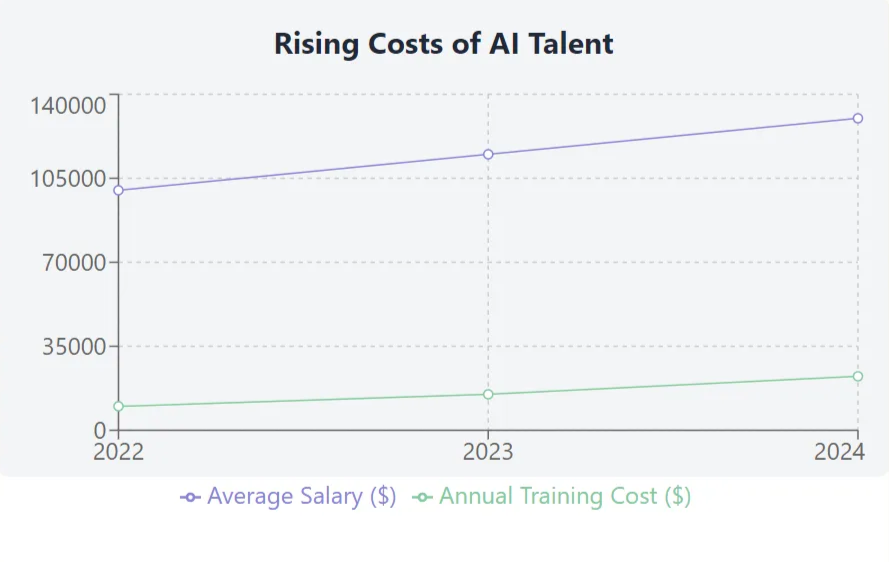

Attracting top-tier AI talent isn’t just a challenge; it’s downright expensive. Salaries for AI specialists have skyrocketed, often surpassing what smaller firms can realistically afford.

Critical Considerations:

- High Salaries: The average salary for AI roles has surged by over 30% in just the last two years.

- Training Costs: On top of that, the need for continuous training and upskilling can add significant financial strain, making in-house development simply unsustainable for many organizations. This is especially true for AI world where there is a new model, vector database or a framework every week.

Line graph titled 'Rising Costs of AI Talent' showing trends from 2022 to 2024 due to ARTSMART.

🤝 The Case for Partners

The situation is no different from industries like aircraft or container leasing, where it doesn't make financial sense for operators to shoulder the capital investment and so the finance world steps in with a solution and takes off this burden from operators.

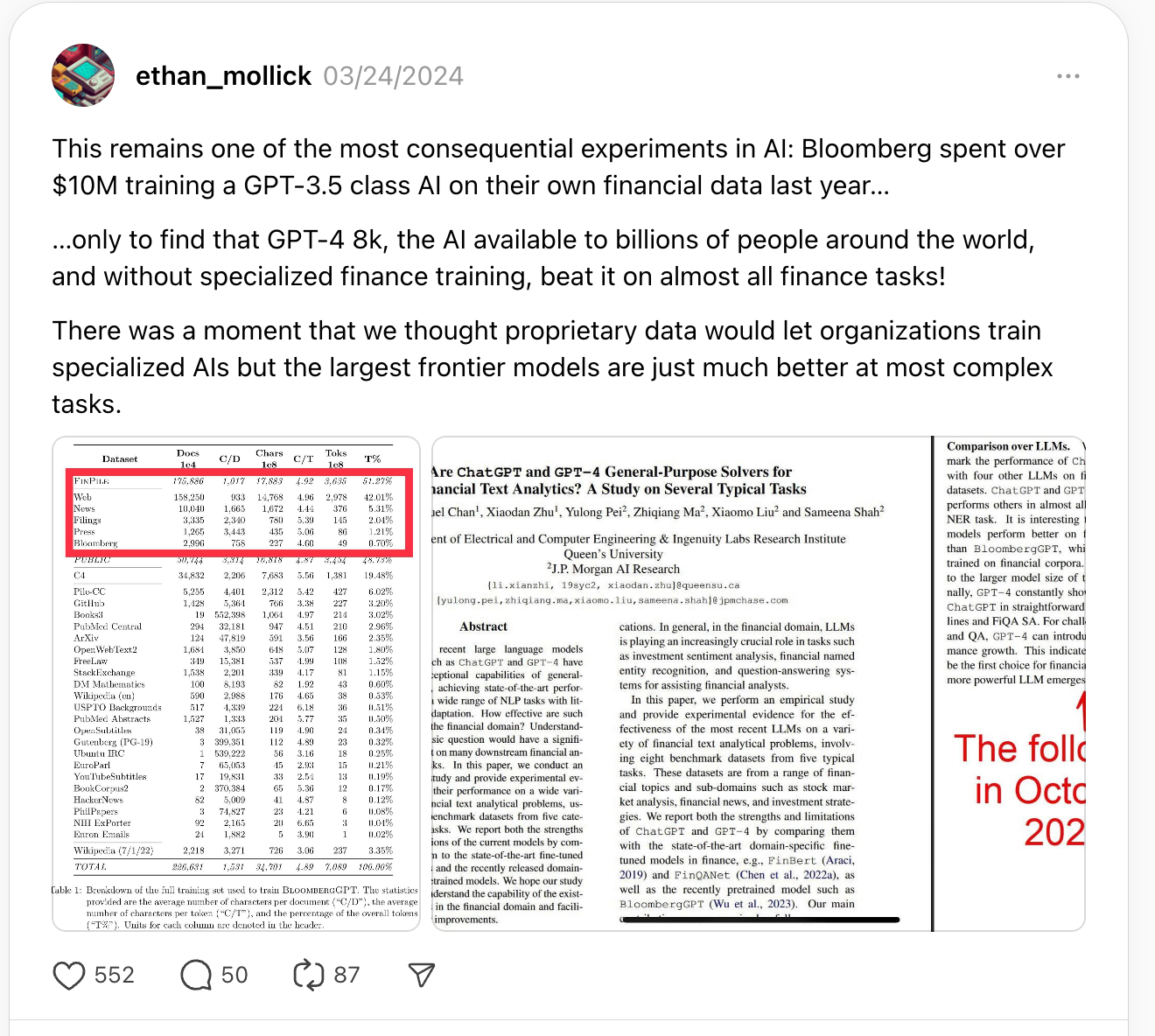

At AnalystAI, we do something similar: it doesn’t make sense for you to invest millions in building an AI team only to fall behind. For instance, Bloomberg recently attempted to develop its own AI model, BloombergGPT, but faced significant challenges, ultimately falling short of expectations. This highlights the complexity and risks of in-house AI development.

You can find the whole new here.

A Linkedln post about Bloomberg failing on its own GPT-model.

Benefits of Collaboration:

- Immediate ROI: Working with AnalystAI, you can see ROI on using AI tomorrow. However, building an AI team, investing in infrastructure, tech, cloud will take months.

- Always on the Edge: AI moves so fast. There is a new model every month. Unless your main job is staying up to date with AI, you will fall behind. Hiring consultants every 6 months doesn’t make sense too. If you want to be on the edge, you need to work with companies who are on the edge.

- Risk Mitigation: Building AI in-house is risky— over 50% of AI projects fail to progress beyond the prototype stage, often due to delays and lack of expertise. Estimates for the failure rate of AI projects vary but can range as high as 85%, according to Deloitte Insights. Challenges include poor data quality, lack of ownership, and deployment issues. Additionally, management of AI models after deployment, such as addressing data drift, often complicates project success. In terms of ERP projects, around 55% to 75% of ERP projects fail to meet expectations due to complexity and management challenges, as highlighted by both Gartner and ERP Research. Ensuring the right people, tools, and processes are aligned with the complexity of the ERP implementation is crucial for increasing the likelihood of success.

🔑 You focus on the ROI, we’ll do the AI

The allure of building proprietary AI solutions can be tempting, but the talent shortage and rising costs make it an unwise gamble. In fact, in our experience, we see even big companies with talent and money are falling behind but it will take them 6-12 months to realize this.

Obviously internal teams do not want to look bad as well, and some will do it well, but most will fail, because you can only keep up with AI if you are working 24/7 on this. If we were doing this just for salary, we wouldn’t spend all day and night on this, and most likely, your internal team doesn’t as well.

At AnalystAI, we are not tech people who jumped onto this train because we think finance is a use case. We are investors who learned AI and built an AI team with the sole goal of serving investors. You will feel the difference in the first meeting; you do not need to talk to us about financial modeling or excel files, we know. Yet you will spend months educating other vendors because in the end, they never worked on a live deal in their lives.

Final Thoughts

The M&A industry exists because large corporations think they can build something in-house, then realize they cannot, and buy it OR they think they can do a new business well, they realize they cannot, so they sell. You see this every 5 years in every industry.

No need to do the same mistake with AI. An investor’s job is to find good assets and acquire them at reasonable prices, manage them well, and sell at the right time. You should use AI to stay competitive, but it’s not an investor’s job to be an AI company. Let us keep you on the edge of AI while you focus on the ROI.

📝 Key Takeaways

- Talent Shortage: Over 80% of companies report a significant shortage of qualified AI professionals, severely limiting their ability to develop effective in-house solutions.

- Cost Implications: The average salary for AI professionals has surged to over $120,000, with ongoing training costs further straining budgets. For many firms, maintaining an in-house AI team is no longer financially viable.

- Strategic Partnerships: Collaborating with specialized AI firms can reduce development timelines by up to 50%, provide immediate access to cutting-edge technologies, and significantly mitigate operational risks. This strategy positions investors to thrive in the competitive AI landscape.

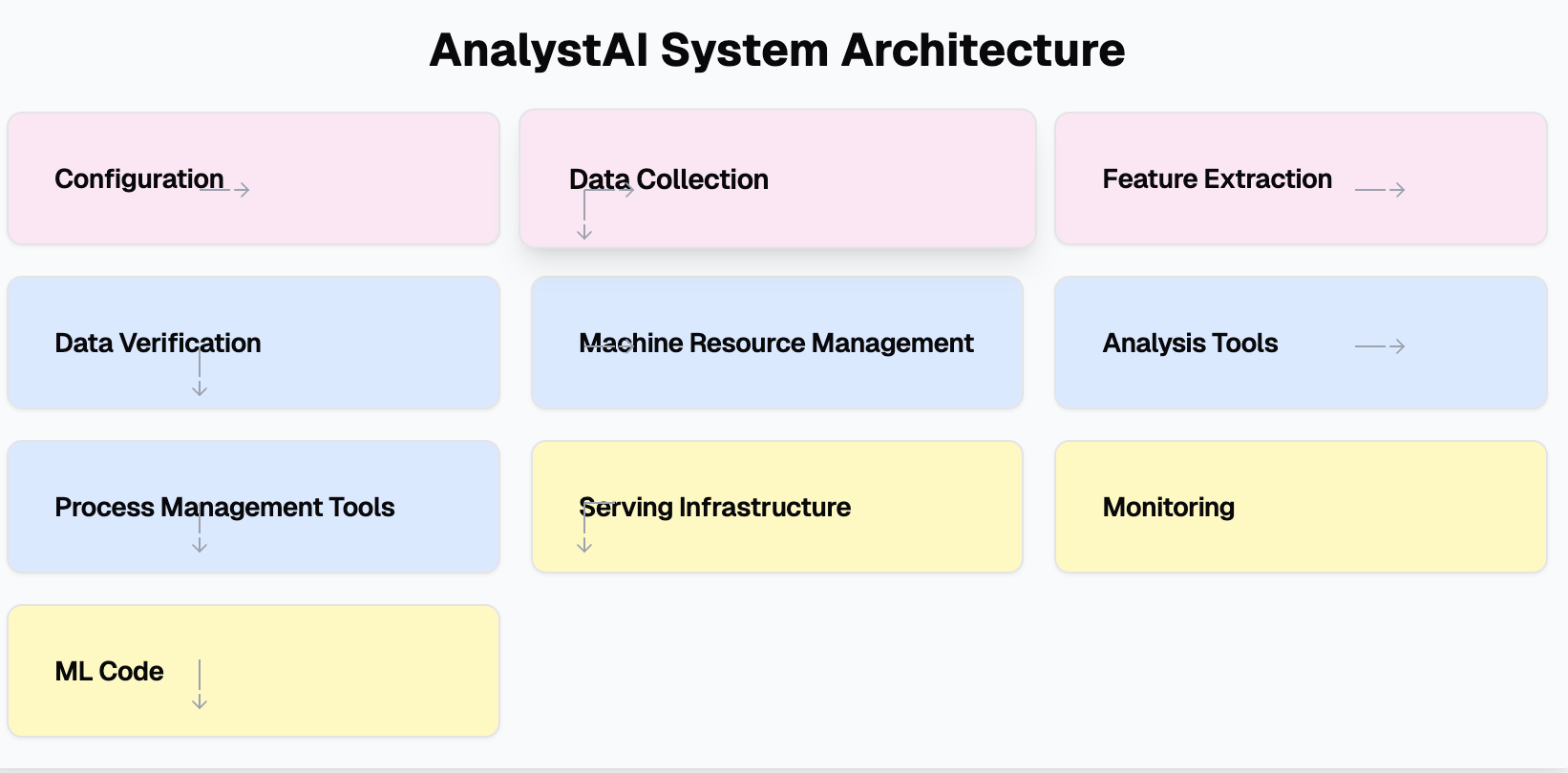

an infographic showing AnalystAI system architecture

For more insights on the state of AI and investment strategies, stay tuned for Analyst AI’s upcoming reports and analyses.